mobicomp-sc.ru

Tools

Forex Foriegn Exchange

Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. Foreign exchange (FX or forex) trading is when you buy and sell foreign currencies to try to make a profit. The foreign exchange market, commonly referred to as the Forex or FX, is the global marketplace for the trading of one nation's currency for another. Forex, also known as foreign exchange or FX trading, is the conversion of one currency into another. Take a closer look at everything you'll need to know about. Get all information and news about the currency market. Find live exchange rates and a currency converter for all foreign currencies. An exchange rate is the rate at which one currency may be converted into another, also called rate of exchange of foreign exchange rate or currency exchange. Forex trading is the act of speculating on the movement of exchange prices by buying one currency while simultaneously selling another. The foreign exchange market (forex, FX (pronounced "fix"), or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of. Get the best currency exchange rates for international money transfers to countries in foreign currencies. Send and receive money with best forex rates. Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. Foreign exchange (FX or forex) trading is when you buy and sell foreign currencies to try to make a profit. The foreign exchange market, commonly referred to as the Forex or FX, is the global marketplace for the trading of one nation's currency for another. Forex, also known as foreign exchange or FX trading, is the conversion of one currency into another. Take a closer look at everything you'll need to know about. Get all information and news about the currency market. Find live exchange rates and a currency converter for all foreign currencies. An exchange rate is the rate at which one currency may be converted into another, also called rate of exchange of foreign exchange rate or currency exchange. Forex trading is the act of speculating on the movement of exchange prices by buying one currency while simultaneously selling another. The foreign exchange market (forex, FX (pronounced "fix"), or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of. Get the best currency exchange rates for international money transfers to countries in foreign currencies. Send and receive money with best forex rates.

Our account holders can order foreign currency online or exchange foreign currency at a financial center. Learn more about our foreign currency exchange. Forex (also known as FX) is simply shorthand for “foreign exchange”, which is the trading of one currency for another. Our Foreign Exchange Currency Converter allows you to quickly convert over 30 foreign currencies. Ready to Get Your Foreign Currency? Learn how to purchase it. We provide the best rates on foreign exchange while maintaining the widest selection of foreign currencies available in stock in our branches across Canada. OANDA's Currency Converter allows you to check the latest foreign exchange average bid/ask rates and convert all major world currencies. Forex trading venues. In general, retail clients have two choices for trading currencies: To trade both futures and forex, a trader needs to have a qualified. Learn about the basics of forex and important considerations for trading currency pairs. Forex trading is provided by Charles Schwab Futures and Forex LLC. What. A foreign currency exchange rate is a price that represents how much it costs to buy the currency of one country using the currency of another country. Strong U.S. dollar creates foreign exchange headwinds for Big Tech. Fri, Oct 21st Markets · U.S. jury finds Credit Suisse did not rig forex market. Thu. With our complete list of foreign exchange (Forex) up-to-the-minute pricing, changes, ranges, day charts and news, Yahoo Finance helps you make informed. Forex is foreign exchange, which refers to the global trading of currencies and currency derivatives. It is the largest financial market in the world, involving. The forex market is traded around the globe, virtually around the clock. Learn more about forex trading with this retail forex guide for beginners. Xe currency tools. FX insights, advanced indicators, live news feeds & customizable dashboards. International transfers. Send money to. The CFTC has witnessed a sharp rise in forex trading scams in recent years and wants to advise you on how to identify potential fraud. StoneX Pro provides a comprehensive suite of FX services to institutional and commercial clients of all sizes globally. We offer turnkey and cost-effective. We offer forex online trading with tight spreads on all the major and minor currency pairs, nearly 24 hours a day, five days a week. Trade forex pairs using our. foreign currency (forex) contracts. Sometimes they even offer lucrative employment opportunities in forex trading. Do these deals sound too good to be true. Forex, also known as foreign exchange or FX is the global market where currencies are traded. It's the largest financial market in the world. They can execute trades for financial institutions, on behalf of clients, or as individual investors. To make profitable trades, forex traders need to be. Forex trading is the buying and selling of global currencies. It's how individuals, businesses, central banks and governments pay for goods and services in.

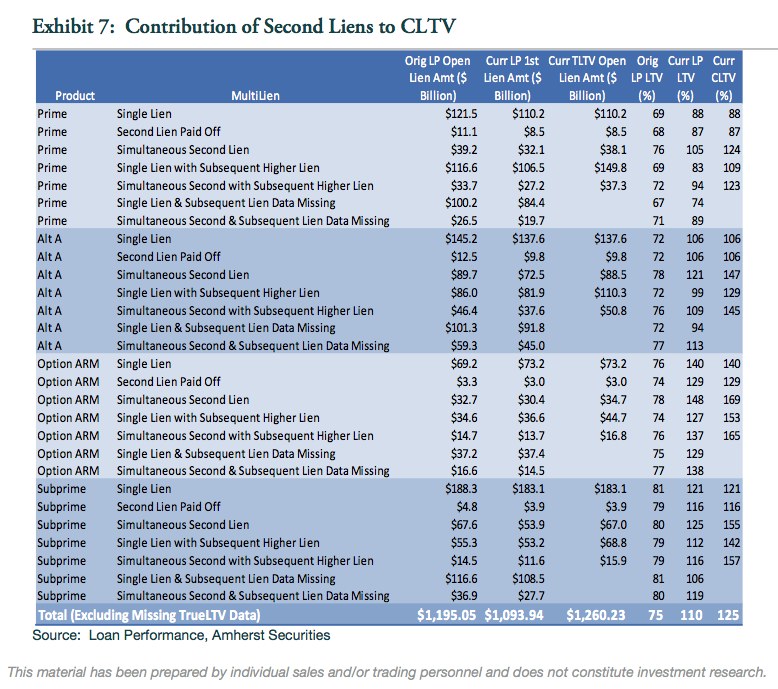

Second Lien Term Loan

Since the second lien and subordinated debt markets again picked up in , intercreditor agreement terms have continued to evolve. The current state of play. A lien is a claim or legal right to a debtor's property or other assets, typically assets that were used as collateral to back a loan. Unlike unsecured debt, second lien loans receive a pledge of specific assets of the borrower (e.g., buildings, land, equipment, intellectual property. In contrast, second lien debt takes a secondary position, following the claims of first lien debt holders. This hierarchical structure significantly shapes the. Most 2nd lien position loans do not sell for top dollar among the note buying community. They are in fact the riskier types of real estate-backed debt to. Second Lien Term Loan, Lender, Banbury Private Capital, September , Lender, March , Hasa, Hasa, Lender, Equity, Second Lien Term Loan, Wind Point. Second-lien financing encompasses a range of products from term loans to high-yield bonds. It can involve lending to borrowers on an asset-based or cashflow. A second lien term loan (the “Term Loan”) to the Borrower in the amount equal to $50,, (subject to the terms of Annex A-I hereto). Any amounts outstanding. We'll try to guide you to the right type of debt. Choose an option Less than $k $k to $k $k to $1 million $1 to $5 million $5 to $10 million $10 to. Since the second lien and subordinated debt markets again picked up in , intercreditor agreement terms have continued to evolve. The current state of play. A lien is a claim or legal right to a debtor's property or other assets, typically assets that were used as collateral to back a loan. Unlike unsecured debt, second lien loans receive a pledge of specific assets of the borrower (e.g., buildings, land, equipment, intellectual property. In contrast, second lien debt takes a secondary position, following the claims of first lien debt holders. This hierarchical structure significantly shapes the. Most 2nd lien position loans do not sell for top dollar among the note buying community. They are in fact the riskier types of real estate-backed debt to. Second Lien Term Loan, Lender, Banbury Private Capital, September , Lender, March , Hasa, Hasa, Lender, Equity, Second Lien Term Loan, Wind Point. Second-lien financing encompasses a range of products from term loans to high-yield bonds. It can involve lending to borrowers on an asset-based or cashflow. A second lien term loan (the “Term Loan”) to the Borrower in the amount equal to $50,, (subject to the terms of Annex A-I hereto). Any amounts outstanding. We'll try to guide you to the right type of debt. Choose an option Less than $k $k to $k $k to $1 million $1 to $5 million $5 to $10 million $10 to.

If the bank holds a first and second lien on a parcel of CRE and the . Term financing: A loan on a stabilized property with a specified repayment schedule and. If the interest rate for financing provided by the property seller is more than 2% below current standard rates for second mortgages, the subordinate financing. We have seen second mortgages (also called “second liens“) used to pay down first mortgages and eliminate mortgage insurance. We have seen owners use a second. If the interest rate for financing provided by the property seller is more than 2% below current standard rates for second mortgages, the subordinate financing. Terms that become tighter in many second lien loans include restrictions on: ∎ Debt and liens. ∎ Investments and restricted payments. Second lien lenders. second lien on other collateral). Governed by agreement among lenders Split-Lien (ABL/Term Loan). Generally controlled by majority lenders. Ideally. Historically, second-lien loans were used in large part to pay off existing debt or provide temporary incremental liquidity. Moreover, second-lien loans can. Second mortgages, commonly referred to as junior liens, are loans secured by a property in addition to the primary mortgage. second lien home equity loan or line of credit. Freddie Mac will purchase eligible first lien mortgages with secondary financing that meet the criteria. Ranking equally with senior debt as to payment prior to acceleration. · Sharing the same security package as the senior debt, in terms of the assets over which. Within the second lien loan market, the most common, and simplest, form of Second-lien lender perspective: seeks a narrower definition – either. Reduced to its basics, in a second lien term loan financing, the first lien lenders agree to allow a junior lien securing the second lien debt on all or part of. Define Second Lien Term Loan Payoff. means the prepayment in full of the Second Lien Term Loan by the Borrowers in an amount equal to $ plus all. In a second lien loan transaction, the second lien lenders hold a second priority security interest on the assets of the borrower. Their security interest ranks. Second lien loans are specifically directed towards middle-market companies that do not have access to the high-yield market or borrowers that would rather. The intent of the Second Lien Program is to ensure that both first and second lien holders are treated fairly and consistently with the priority of their liens. A Practice Note discussing second lien loans and their characteristics, including terms commonly included in second lien loans and how they differ from. In a second lien loan transaction, the second lien lenders hold a second priority security interest on the assets of the borrower. Their security interest ranks. Must close simultaneous with a Fannie Mae Eligible JMAC first lien. •. If Borrower receives more cash back than allowed on a rate/term refinance, the loan will.

Clover Point Of Sale System Reviews

Overall: The Clover POS system provides a comprehensive and flexible solution for managing various business operations. Its user-friendly interface and. Unlike the older Clover POS system, the new features built-in chip card capabilities. You can accept credit and debit, NFC (contactless) payments, and cash. Easy, simple and effective. Very positive. It's ease of use makes it suitable for every demographic and It integrates well with our other systems like Shopify. Clover is easy to use and set up, and the most substantial positive about this app is its usability and ease of use. It provides many features/tools for your. Clover is ranked #3 in the POS Software product directory based on the latest available data collected by SelectHub. Compare the leaders with our In-Depth. Before You Buy a Clover POS System The Clover station, a sleek point of sale system available on the Fiserv (formerly First Data) platform, is an. Clover Review. Clover is very easy to use, doesn't take much space and it makes paying for merchandise and services fast and easy. PROS. To better analyze how Clover's POS system compares with other platforms on the market, let's explore firsthand experiences with the software. Overall, Clover. It was extremely easy to set up, and easy to use. The user interface is beautiful, and customers really enjoy how sleek and clean it looks. Overall: The Clover POS system provides a comprehensive and flexible solution for managing various business operations. Its user-friendly interface and. Unlike the older Clover POS system, the new features built-in chip card capabilities. You can accept credit and debit, NFC (contactless) payments, and cash. Easy, simple and effective. Very positive. It's ease of use makes it suitable for every demographic and It integrates well with our other systems like Shopify. Clover is easy to use and set up, and the most substantial positive about this app is its usability and ease of use. It provides many features/tools for your. Clover is ranked #3 in the POS Software product directory based on the latest available data collected by SelectHub. Compare the leaders with our In-Depth. Before You Buy a Clover POS System The Clover station, a sleek point of sale system available on the Fiserv (formerly First Data) platform, is an. Clover Review. Clover is very easy to use, doesn't take much space and it makes paying for merchandise and services fast and easy. PROS. To better analyze how Clover's POS system compares with other platforms on the market, let's explore firsthand experiences with the software. Overall, Clover. It was extremely easy to set up, and easy to use. The user interface is beautiful, and customers really enjoy how sleek and clean it looks.

people have already reviewed Clover POS. Read about their experiences and share your own!

Clover has a lot to offer small businesses that want one vendor for all their credit card processing and POS needs, but there is a potential downside to that. 6 reviews for Clover Mini Point of Sale System (New ) Works perfect for my wife's boutique. Gives her everything she needs and lets me manage the finances. Clover POS systems have access to a tremendous library of apps that merchants can easily download and set up. The ingenuity of the company's app store has. Retail POS systems designed to streamline your store · More than , retailers use Clover's small business retail POS system today to run their businesses. the equipment looks good the customer interface is good but the back office doesn't exist no supply information or incoming invoicing ability. Clover POS has been a savior to my business. The apps and tools offered have made my life so much easier and allowed me to concentrate on making my business. Compatible through both the Apple iOS and Android app store, Clover Go is a small point of sale system for small businesses taking payments quickly, including. Design of Clover Flex Card Processing POS System The hardware of the Clover Flex POS is larger than what is suitable for a mobile device. It is somewhat bulky. Clover is a user-friendly point-of-sale (POS) system designed for small to medium businesses, offering a range of software and hardware tailored to different. Explore verified Clover reviews, up-to-date pricing, helpful pros and cons, & alternatives to other Point of Sale tools. Overall, business owners choose Clover for its ease of use and all-in-one capabilities. All hardware comes pre-configured with Clover's custom Android operating. Clover is a good point of sale system for retail and food-service businesses. It offers a suite of hardware options and a large App Marketplace. Clover POS is a point-of-sale system that can run on any mobile device or tablet. The software allows users to manage payments, inventory, and customer. Before You Buy a Clover POS System The Clover station, a sleek point of sale system available on the Fiserv (formerly First Data) platform, is an. Clover is our pick for the POS system with the best overall value, thanks to its durable hardware, low payment processing fees and robust customer support. Clover POS is not a good option because once it is programmed, you cannot switch processors if you don't like the service or the rates, and you. Beauty and brains all-in-one POS: Attractive and easy-to-use hardware with a printer and included cash drawer and all the right software in one system. It's. This system is fine for a small retail business or even a single transaction business. DO NOT buy this system for a busy alacarte restaurant. It contains. Why We Chose Clover as the Best POS Credit Card Processor · Clover offers various pricing plans for its POS system and credit card processing based on business.

Doordash Vs Ubereats

Uber Eats, DoorDash, and Grubhub are some of the most well known apps at the forefront of this innovation, each providing unique services that cater to. Order Starbucks® delivery on DoorDash or Uber Eats and let your favorites come to you. Doordash Logo. Order now. UberEats Logo. DoorDash also has the highest cash out fee at $ , compared to UberEats, which is increasing to $ and Grubhub at 50 cents per cashout. Vuelvo y les digo, uber eats es la mejor en mi área, pero en mi opinión muy muy personal. Ambas aplicaciones tienen cosas muy buenas, ambas les puedo decir. Please check with each provider directly for its latest fee structure. Let's uncover what it really costs to use UberEats, PostMates, GrubHub, or DoorDash. Compare Deliveroo vs. DoorDash vs. Uber Eats using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the best. DoorDash and Uber Eats are user-friendly apps, but we've found that DoorDash drivers earn more per hour and have more control with scheduling. Grubhub and DoorDash are familiar names that have led the charge in sales. Uber Eats has been the definition of rapid growth, becoming the most widely available. GrubHub trails slightly behind at %, Uber Eats with %, and Postmates – which confidentially filed for an IPO in February – holds a little more than 12%. Uber Eats, DoorDash, and Grubhub are some of the most well known apps at the forefront of this innovation, each providing unique services that cater to. Order Starbucks® delivery on DoorDash or Uber Eats and let your favorites come to you. Doordash Logo. Order now. UberEats Logo. DoorDash also has the highest cash out fee at $ , compared to UberEats, which is increasing to $ and Grubhub at 50 cents per cashout. Vuelvo y les digo, uber eats es la mejor en mi área, pero en mi opinión muy muy personal. Ambas aplicaciones tienen cosas muy buenas, ambas les puedo decir. Please check with each provider directly for its latest fee structure. Let's uncover what it really costs to use UberEats, PostMates, GrubHub, or DoorDash. Compare Deliveroo vs. DoorDash vs. Uber Eats using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the best. DoorDash and Uber Eats are user-friendly apps, but we've found that DoorDash drivers earn more per hour and have more control with scheduling. Grubhub and DoorDash are familiar names that have led the charge in sales. Uber Eats has been the definition of rapid growth, becoming the most widely available. GrubHub trails slightly behind at %, Uber Eats with %, and Postmates – which confidentially filed for an IPO in February – holds a little more than 12%.

Compare DoorDash vs. Menulog vs. Uber Eats using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the best. Uber Eats · delivering products and food when you are incapable or unable to drive · quick delivery · various types of deliveries are available on doordash. Or maybe you drive with Uber or are an Uber Eats customer and want to supplement your income. DoorDash, Google, Grubhub, Waitr, or any other food. Can I order delivery through Uber Eats, Postmates, DoorDash, or Grubhub? Yes, you can still order your Taco Bell favorites on these third party apps. Does. For instance, you can get a $ to $ order, and you will get around $21 tip for that delivery. It might take an hour to complete one or two deliveries for. Tech Talk: Covered or Not? Delivery-for-Hire and the MAP — Grubhub, DoorDash, Uber Eats, Amazon Flex, etc. This content is restricted to site members. If. Get a comparison of working at DoorDash vs UberEATS. Compare ratings, reviews, salaries and work-life balance to make the right decision for your career. If you frequently order food during busy hours or you don't mind paying a monthly subscription fee, then DoorDash or Uber Eats could be cheaper options for you. Uber Eats makes it easy to order food delivery online or through the app and have it delivered by restaurants and delivery people near you. Or, schedule your. DoorDash, GrubHub, and UberEATS have entirely transformed how Americans eat and interact with restaurants. But none of these companies have escaped media. On average, ordering meals through Uber Eats costs between $2 and $5 in delivery charges, depending on how distant the restaurant is from your home. DoorDash rates % higher than UberEATS on Leadership Culture Ratings vs UberEATS Ratings based on looking at ratings from employees of the two companies. Compare mobicomp-sc.ru vs mobicomp-sc.ru traffic analysis, see why mobicomp-sc.ru in ranked #1 in the Restaurants and Delivery category and mobicomp-sc.ru is # The Uber eats delivery fee is dynamic and ranges from $ to $ It's calculated based on the proximity of the restaurant, demand for orders, and. Jessica Nicole Owens Doordash is better here but Uber does hit you with nice delivery orders, every so often. Two popular delivery apps to have in your rotation are DoorDash and Uber Eats. Let's take a look at how they compare to see why both food delivery apps should. Opt in to receive SMS messages and calls. By opting in, I agree to receive calls or SMS messages for Uber Eats merchant account updates, including by. DoorDash is most highly rated for Work-life balance and UberEATS is most highly rated for Work-life balance. Learn more, read reviews, and see open jobs. DoorDash is the preferred choice for online food delivery among more than 32 million users. It holds a dominant 57% share of the online food delivery market in.

Oak Street Health Financials

Discover details on Oak Street Health Inc's annual and quarterly financial performance covering key metrics like revenue, net income, growth ratios. Dun & Bradstreet collects private company financials for more than 23 million companies worldwide. What is Oak Street Health, Inc.'s website? Oak Street. OAK STREET HEALTH, INC. CONSOLIDATED FINANCIAL STATEMENTS. For the quarterly period ended September 30, 5. OAK STREET HEALTH, INC. CONSOLIDATED BALANCE. Dun & Bradstreet collects private company financials for more than 23 million companies worldwide. What is Oak Street Health, Inc.'s website? Oak Street. Oak Street Health may be growing as indicated by the pursuit of private equity funding to support its expansion. Multiple news sources report that CVS is. Oak Street Health LLC is a network of primary care centers for adults on Medicare Revenue. Employees vs. Revenue Chart. Latest Funding Round — Round Equity. Funding, Valuation & Revenue Oak Street Health has raised $M over 8 rounds. Oak Street Health's latest funding round was a Acq - P2P for on May 2, In May , Oak Street Health was acquired by CVS Health for a valuation of $B. Headquarters Location. 30 West Monroe Street Suite Chicago, Illinois. According to Oak Street Health 's latest financial reports the company's current revenue (TTM) is $ B. In the company made a revenue of $ B an. Discover details on Oak Street Health Inc's annual and quarterly financial performance covering key metrics like revenue, net income, growth ratios. Dun & Bradstreet collects private company financials for more than 23 million companies worldwide. What is Oak Street Health, Inc.'s website? Oak Street. OAK STREET HEALTH, INC. CONSOLIDATED FINANCIAL STATEMENTS. For the quarterly period ended September 30, 5. OAK STREET HEALTH, INC. CONSOLIDATED BALANCE. Dun & Bradstreet collects private company financials for more than 23 million companies worldwide. What is Oak Street Health, Inc.'s website? Oak Street. Oak Street Health may be growing as indicated by the pursuit of private equity funding to support its expansion. Multiple news sources report that CVS is. Oak Street Health LLC is a network of primary care centers for adults on Medicare Revenue. Employees vs. Revenue Chart. Latest Funding Round — Round Equity. Funding, Valuation & Revenue Oak Street Health has raised $M over 8 rounds. Oak Street Health's latest funding round was a Acq - P2P for on May 2, In May , Oak Street Health was acquired by CVS Health for a valuation of $B. Headquarters Location. 30 West Monroe Street Suite Chicago, Illinois. According to Oak Street Health 's latest financial reports the company's current revenue (TTM) is $ B. In the company made a revenue of $ B an.

Based on the key indicators related to Oak Street's liquidity, profitability, solvency, and operating efficiency, Oak Street Health is not in a good. Their revenue is roughly the entire insurance premium—about $ per patient per month—but in exchange, they are responsible for all downstream. Oak Street Health, Inc. (OSH) DCF Valuation. | | |. Real-Time Price (). Dashboard; DCF Model; WACC; Financials; Ratios; Profile. History · Vision. Market Cap. Oak Street Health has 4 employees across locations and $ b in annual revenue in FY See insights on Oak Street Health including office. Oak Street Health, Inc. Revenue | OSH ; , $2, ; , $1, ; , $ ; , $ Oak Street Health, LLC top competitors by domain ; Company NameAARP ; Employees - ; HQUnited States, District of Columbia, Washington ; Annual revenue> $1. Oak Street Health's Profile, Revenue and Employees. Oak Street Health is an Illinois-based healthcare organization that operates a chain of primary care. Based on the financial report for Dec 31, , Oak Street Health Inc's Revenue amounts to B USD. What is Oak Street Health Inc's Revenue growth rate? Dun & Bradstreet collects private company financials for more than 23 million companies worldwide. How many employees does Oak Street Health, LLC have? Oak. It received Energage's Top Workplaces USA award, and the 20Joy in Medicine™ Health System Recognition Program. In February , CVS Health. Find an Oak Street Health primary care physician and doctor near me, who makes it easier for adults on Medicare to stay healthy by spending more time with. Oak Street Health has raised a total of $M in funding over 5 rounds. Their latest funding was raised on Nov 16, from a Post-IPO Debt round. As of August , Oak Street Health's annual revenue reached $B. What is Oak Street Health's SIC code NAICS code? Estimates* ; Profit, , ; % profit margin, (25 %), (19 %) ; EV / revenue, x, x ; EV / EBITDA, x, x. , Asset Disposal, In January, the company sold two Oak Street Health properties for US$ million in Iowa and Louisiana in the US to Four Corners Property. Oak Street Health Inc (OSH) ; Market Cap: B ; Shares Outstanding: ,, ; Revenue: B ; Net Income: ; EPS: Oak Street Health, Inc. is a health care network of primary care centers for older adults with Medicare. Oak Street Health, Inc. In May , CVS Health. Oak Street Health's Profile, Revenue and Employees. Oak Street Health is an Illinois-based healthcare organization that operates a chain of primary care. The current revenue for Oak Street Health is How much funding has Oak Street Health raised over time? Oak Street Health has raised $M. Who are Oak. Oak Street Health's official website is mobicomp-sc.ru What is Oak Street Health's Revenue? Oak Street Health's revenue is $ Billion What is Oak.

Which Is Better To Invest In Stocks Or Bonds

If you choose to invest in a company, there are two routes available to you – equity (also known as stocks or shares) and debt (also known as bonds). However, stocks have provided higher returns over longer periods of time. If you plan to be invested for at least 10 years, stocks can offer more potential for. While bonds tend to be a safer investment than stocks, they also come with potential risks, one of them being interest rate risk. Interest rates can have a. Wondering about bonds? They're well worth considering when building out your investment portfolio. They come with many potential benefits, including capital. Most are less risky than individual stocks because mutual funds spread the risk across multiple investments. There are hundreds of mutual funds out there. In the following chart, you can see that stocks have a long track record of providing higher returns than bonds or cash alternatives. In fact, large domestic. Bonds are more beneficial for investors who want less exposure to risk but still want to receive a return. Fixed-income investments are much less volatile than. Bonds can play a vital role in any investment portfolio. Bonds yield income, are often considered less risky than stocks and can help diversify your portfolio. Nothing is better for everyone. It depends on your goals, needs and risk tolerance. Stocks have a much higher likelihood of greater growth over. If you choose to invest in a company, there are two routes available to you – equity (also known as stocks or shares) and debt (also known as bonds). However, stocks have provided higher returns over longer periods of time. If you plan to be invested for at least 10 years, stocks can offer more potential for. While bonds tend to be a safer investment than stocks, they also come with potential risks, one of them being interest rate risk. Interest rates can have a. Wondering about bonds? They're well worth considering when building out your investment portfolio. They come with many potential benefits, including capital. Most are less risky than individual stocks because mutual funds spread the risk across multiple investments. There are hundreds of mutual funds out there. In the following chart, you can see that stocks have a long track record of providing higher returns than bonds or cash alternatives. In fact, large domestic. Bonds are more beneficial for investors who want less exposure to risk but still want to receive a return. Fixed-income investments are much less volatile than. Bonds can play a vital role in any investment portfolio. Bonds yield income, are often considered less risky than stocks and can help diversify your portfolio. Nothing is better for everyone. It depends on your goals, needs and risk tolerance. Stocks have a much higher likelihood of greater growth over.

Even though bonds may outperform for a certain period of time, stocks have higher expected returns and are expected to outperform over the long. Whether you should invest in bonds or stocks depends on your individual financial goals and risk tolerance. Generally, stocks offer higher potential returns but. If you choose to invest in a company, there are two routes available to you – equity (also known as stocks or shares) and debt (also known as bonds). invest in stocks, bonds, and other assets. What are ETFs? By Beginner | 5 min read. Exchange-traded funds, or ETFs, have made investing easier and more. Stocks offer ownership and dividends, volatile short-term but driven by long-term earnings growth. Bonds provide stable income, crucial for wealth protection. A common option for beginning investors is putting money into an Exchange-Traded Fund (commonly referred to as an ETF). “ETFs are a collection of securities. In the following chart, you can see that stocks have a long track record of providing higher returns than bonds or cash alternatives. In fact, large domestic. If you need a shorter-term strategy, you might do better to consider bonds. Although bonds may not perform as well as stocks over any period in which major. Real estate has more upside as interest rates decline due to the rental income and principal upside component. However, bonds have a steady return with a high. For stocks to be the better investment, investors will need to be compensated for the extra risk – this can be either through higher yields, which is. However, issuing bonds has distinct advantages over issuing new shares. Stock issuance dilutes ownership, meaning future earnings are shared. Bonds are more conservative investments: Unlike stock investments, investing in bonds promises a fixed interest rate that will yield a guaranteed return. What is a Stock? When an investor buys a stock, part ownership in the form of a share is bought. · What is a Bond? Bonds are a type of investment designed to aid. Bonds typically pay a low rate of return, while returns associated with stocks can be higher. Stocks tend to be riskier investments because they can fluctuate a. Therefore, you could say that they are a relatively safer investment. However, some traders thrive on the unknown and volatility within the stock market. If you intend to purchase securities - such as stocks, bonds, or mutual better investment returns in another asset category. In addition, asset. The higher volatility of stocks relative to bonds is due to the nature of the two types of investments. When you buy stocks, you're buying ownership in. In moderate environments, stocks tend to fare better than bonds in rising-rate environments, while bonds tend to fare better than stocks in falling-rate. If you need your investments to produce income, then it is important to decide if corporate bonds or dividend stocks are a better place for you to be. In a low. Stocks represent shares in individual companies while mutual funds can include hundreds — or even thousands — of stocks, bonds or other assets.

How Do I Get A Robinhood Debit Card

Robinhood Gold Card is offered by Robinhood Credit, Inc., and is issued by Coastal Community Bank, pursuant to a license from Visa U.S.A. Inc. Robinhood. Robinhood Gold accounts. Two microdeposits are activated when you link a debit card. These expire in 48 hours and provide temporary funds. The Robinhood debit card is provided to customers who upgrade their Robinhood brokerage account to enable Cash Management features. You can use the Robinhood. The Robinhood Gold Card is the only credit card you'll need, and it's exclusively for Robinhood Gold members.* 3% CASH BACK ACROSS THE BOARD. There's no fee for bank transfers. However, instant withdrawals to a debit card or bank account can incur up to a % fee. Direct Debit is available for Adult and Under 19 monthly renewals. Please pop into our Nottingham Travel Centre on Smithy Row to complete the Direct Debit. When you open a Robinhood spending account, you can get a Robinhood Cash Card issued by Sutton Bank. If you don't want a physical debit card, you can opt for a. The Robinhood Gold Card is the only credit card you'll need, and it's Robinhood is not a bank. *See full rates and fee details. The Gold Card. The Robinhood Gold Credit Card has its own separate app, the Robinhood Credit Card app. This ensures you have 1 app specifically for investing. Robinhood Gold Card is offered by Robinhood Credit, Inc., and is issued by Coastal Community Bank, pursuant to a license from Visa U.S.A. Inc. Robinhood. Robinhood Gold accounts. Two microdeposits are activated when you link a debit card. These expire in 48 hours and provide temporary funds. The Robinhood debit card is provided to customers who upgrade their Robinhood brokerage account to enable Cash Management features. You can use the Robinhood. The Robinhood Gold Card is the only credit card you'll need, and it's exclusively for Robinhood Gold members.* 3% CASH BACK ACROSS THE BOARD. There's no fee for bank transfers. However, instant withdrawals to a debit card or bank account can incur up to a % fee. Direct Debit is available for Adult and Under 19 monthly renewals. Please pop into our Nottingham Travel Centre on Smithy Row to complete the Direct Debit. When you open a Robinhood spending account, you can get a Robinhood Cash Card issued by Sutton Bank. If you don't want a physical debit card, you can opt for a. The Robinhood Gold Card is the only credit card you'll need, and it's Robinhood is not a bank. *See full rates and fee details. The Gold Card. The Robinhood Gold Credit Card has its own separate app, the Robinhood Credit Card app. This ensures you have 1 app specifically for investing.

16 votes, 32 comments. Has anyone looked into getting the Robinhood debit card? What does the % bonus on transactions mean? The Robinhood Gold Card is the only credit card you'll need, and it's exclusively for Robinhood Gold members.* 3% CASH BACK ACROSS THE BOARD. To unlink your bank or external debit card account from Robinhood · Select Account · In Linked accounts, select Unlink next to the account you want to unlink. Two microdeposits are activated when you link a debit card. These Robinhood account and their bank accounts. These transfers may be. Contact Robinhood by phone at () or visit mobicomp-sc.ru for any customer service issues. Round-ups are sent from your spending account with. Debit card: Robinhood Connect supports Visa and Mastercard. The debit card has to be issued in the US. Prepaid cards are not accepted. Bank transfer. With Cash Card Offers, you'll get cash back in your spending account by using your Robinhood Cash Card at your favorite brands with no activation required. Yes, you can add money to Robinhood without a bank account. You can use a debit card, a prepaid debit card, or a third-party payment processor. It is made possible by a bank partnership with Sutton Bank, Member FDIC. Robinhood Cash Card is available in 50 states and Washington, DC. Key Takeaways. Earn a. The Robinhood Debit Card is a prepaid card issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard® International Incorporated. Mastercard. No. They changed the way the account is setup. So the new card is their "spending" account which can round up like acorn if you do choose. Then. Unfortunately, we can't accept debit cards that function as checking accounts. You'll know it's a valid checking account if it provides monthly statements. The Card is not a gift card, a device that accesses money in an individual checking or savings account, a bank deposit account, a debit card, or a credit card. Note. You'll need to enable location permissions to use the ATM Finder. Disclosures. Disclosures. Was this article helpful? Reference No. Keep in mind that after a card is reported as lost or stolen, it'll be canceled and we'll issue you new card information, free of charge. If you opted in for a. Need Some Support? How to use your Robin Hood Card. Information for bus, tram Information for Direct Debit, Season Cards and Robin Hood Pay As You Go. Robinhood offers two ways to withdraw money: by debit card or bank account. To withdraw money from Robinhood online, follow these steps: +1-() 1. The Gold Card has no annual fee, however, it's only available to those with an annual Robinhood Gold subscription. If you're not currently a Robinhood Gold. Debit card: Robinhood Connect supports Visa and Mastercard. The debit card has to be issued in the US. Prepaid cards are not accepted. Bank transfer.

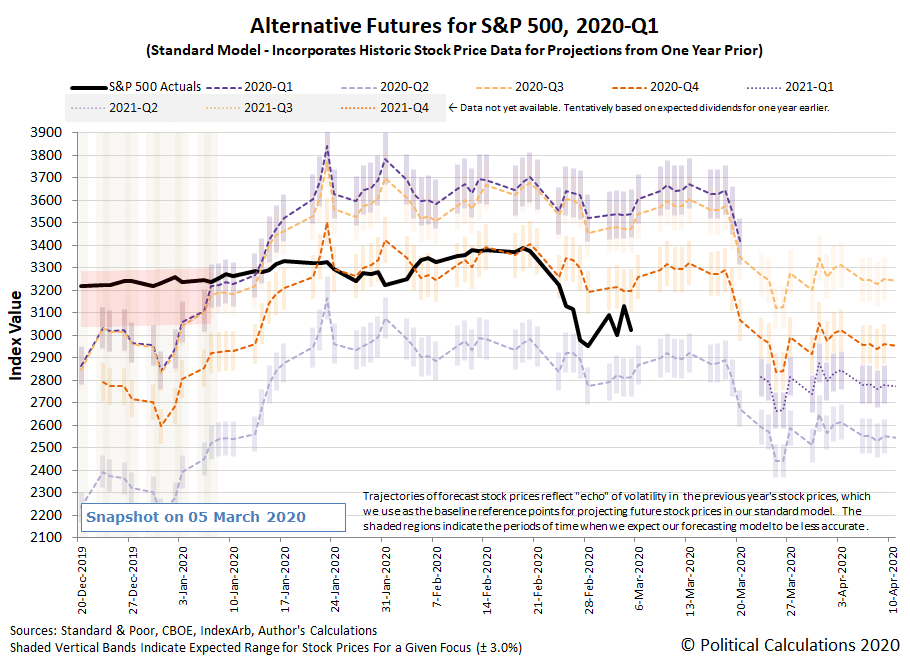

Sp 500 Volatility

In depth view into CBOE S&P Volatility Index including performance, historical levels from , charts and stats. The most well-known measure of market sentiment is the CBOE Volatility Index, or VIX. The VIX measures expected price fluctuations or volatility in the S&P The VIX Index is a calculation designed to produce a measure of constant, day expected volatility of the U.S. stock market, derived from real-time, mid-quote. To summarize, VIX is a volatility index derived from S&P options for the 30 days following the measurement date, with the price of each option representing. See all ETFs tracking the S&P Low Volatility Index, including the cheapest and the most popular among them. Compare their price, performance, expens. It can occur on the upside, too! Here are some charts and tables with historical volatility and returns on the Nasdaq vs the S&P. Bloomberg Ticker: SPXVHUP. The S&P ® Volatility - Highest Quintile Index is designed to measure performance of the most-volatile stocks in the S&P When there is a spike in the VIX, this means traders in the S&P options market expect that market volatility will increase. The higher the VIX Index. Live VIX Index quote, charts, historical data, analysis and news. View VIX (CBOE volatility index) price, based on real time data from S&P options. In depth view into CBOE S&P Volatility Index including performance, historical levels from , charts and stats. The most well-known measure of market sentiment is the CBOE Volatility Index, or VIX. The VIX measures expected price fluctuations or volatility in the S&P The VIX Index is a calculation designed to produce a measure of constant, day expected volatility of the U.S. stock market, derived from real-time, mid-quote. To summarize, VIX is a volatility index derived from S&P options for the 30 days following the measurement date, with the price of each option representing. See all ETFs tracking the S&P Low Volatility Index, including the cheapest and the most popular among them. Compare their price, performance, expens. It can occur on the upside, too! Here are some charts and tables with historical volatility and returns on the Nasdaq vs the S&P. Bloomberg Ticker: SPXVHUP. The S&P ® Volatility - Highest Quintile Index is designed to measure performance of the most-volatile stocks in the S&P When there is a spike in the VIX, this means traders in the S&P options market expect that market volatility will increase. The higher the VIX Index. Live VIX Index quote, charts, historical data, analysis and news. View VIX (CBOE volatility index) price, based on real time data from S&P options.

Find the latest CBOE Volatility Index (^VIX) stock quote, history, news and Here's How the S&P Performed in August. (Hint: The Experts Weren't. Designed to provide leveraged exposure to the S&P ® Index based on a dynamic volatility target, subject to a minimum exposure of % and a maximum exposure. Data Suggestions Based On Your Search · CBOE S&P 3-Month Volatility Index · S&P · TED Spread (DISCONTINUED) · CBOE Crude Oil ETF Volatility Index. ULV.C invests in either securities of Invesco S&P ® Low Volatility ETF (NYSE Arca ticker: SPLV) or in securities of U.S.-listed companies in order. The current value of Volatility S&P Index is USD — it has fallen by −% in the past 24 hours. Track the index more closely on the Volatility S&P. Screen on volatility, expiration date, moneyness, volume and more. Sign up for a risk-free day trial today. have an inverse correlation to the S&P Index. When the market is down, fear is up, and vice versa. A score below 20 generally indicates investor contentment. The Chicago Board Options Exchange (CBOE) Market Volatility (VIX). Index shows the market's expectation of day volatility. The S&P Total Return Index is. The Share Class seeks to track the performance of an index composed of selected large cap U.S. companies that, in the aggregate, have lower volatility. The Volatility Index or VIX is the annualized implied volatility of a hypothetical S&P stock option with 30 days to expiration. The Chicago Board Options Exchange S&P 1-Month Volatility Index (VIX1M) measures the market's expectation of day volatility implicit in the prices of. Historical analysis of the S&P Minimum Volatility index between December and July The VIX measures the implied volatility of the S&P (SPX), based on the price of SPX options. It is calculated and published by the Chicago Board Options. VIX | A complete Cboe Volatility Index index overview by MarketWatch. View S&P Index, 5,, , %. Russell Index, 2,, , %. Graph and download economic data for CBOE S&P 3-Month Volatility Index (VXVCLS) from to about VIX, volatility, 3-month. The VIX uses a mathematical formula that measures how much the market thinks the S&P Index option (SPX) will fluctuate over the next 30 days, using an. Real time data on CBOE VIX Index Futures. The Chicago Board Options Exchange Volatility Index is a popular measure of the implied volatility of S&P index. The Invesco S&P ® Low Volatility ETF (Fund) is based on the S&P ® Low Volatility Index (Index). The Fund will invest at least 90% of its total assets in. The VIX index measures the expectation of stock market volatility over the next 30 days implied by S&P index options. The current VIX index level as of.

Best Instant Check Cashing App

Financial Control at your Fingertips. With the The Check Cashing Store® Mobile app, you can view your transaction history so you always know your card. Ingo Money offers a similar feature to Venmo parent company, PayPal, allowing users to cash checks in the PayPal app. “We're always looking for new ways to make. Cash your checks online with the PayPal app and make bank trips a thing of the past. Find out more about online check depositing and get the app today. Cash checks for less · $4 maximum fee¹. For preprinted checks cashed up to $1, · Get cash in a flash. Bring your check & valid ID to a Walmart store. Breadcrumbs. Home; Check Cashing – Cash a Check Near You | Money Services The best bit? It's quick, secure and efficient. You can enjoy everyday low fees. 1. Ingo Money: This app allows users to cash checks by simply taking a photo of the front and back of the check. · 2. PayPal: The PayPal mobile. Cash a check with our mobile app and, if approved, get your money in minutes. Just snap a few pictures with your phone and the money can be loaded to a debit. Cash a check with Ingo Money and, if your check is approved, get your money in minutes in your bank, prepaid card or PayPal account. No check cashing lines. No. The top instant check cashing apps without verification include Ingo Money, Brink's Money, PayPal, Venmo, Cash App, Chime, and Flare Account. Financial Control at your Fingertips. With the The Check Cashing Store® Mobile app, you can view your transaction history so you always know your card. Ingo Money offers a similar feature to Venmo parent company, PayPal, allowing users to cash checks in the PayPal app. “We're always looking for new ways to make. Cash your checks online with the PayPal app and make bank trips a thing of the past. Find out more about online check depositing and get the app today. Cash checks for less · $4 maximum fee¹. For preprinted checks cashed up to $1, · Get cash in a flash. Bring your check & valid ID to a Walmart store. Breadcrumbs. Home; Check Cashing – Cash a Check Near You | Money Services The best bit? It's quick, secure and efficient. You can enjoy everyday low fees. 1. Ingo Money: This app allows users to cash checks by simply taking a photo of the front and back of the check. · 2. PayPal: The PayPal mobile. Cash a check with our mobile app and, if approved, get your money in minutes. Just snap a few pictures with your phone and the money can be loaded to a debit. Cash a check with Ingo Money and, if your check is approved, get your money in minutes in your bank, prepaid card or PayPal account. No check cashing lines. No. The top instant check cashing apps without verification include Ingo Money, Brink's Money, PayPal, Venmo, Cash App, Chime, and Flare Account.

Yes, you can cash checks online instantly without a bank account by using mobile payment apps like PayPal, Cash App, or Venmo, or by utilizing. Zil is the ideal solution for anyone looking for a way for instant online check cashing. There's no need to visit a bank or an ATM with Zil. Ingo Money, Brink's Money, PayPal, Venmo, Cash App, Chime, and Flare Account are some of the top instant check cashing apps that allow you. The Lodefast Check Cashing app allows you to cash checks and access your money anytime, anywhere, without waiting in lines or driving to a store or bank. Cash Checks and get your money instantly loaded onto any Debit Card. Financial Control at your Fingertips. Mobile deposits are safe and convenient. Discover what a mobile check deposit is and how to get started on the Chase Mobile® app It's best to limit your. With the PNC Mobile app you can securely deposit checks and access funds using your tablet or mobile phone & access your money faster with PNC Express. Financial Control at your Fingertips. With the The Check Cashing Store® Mobile app, you can now deposit your checks directly to your bank account or your. Regions offers check cashing services — including handwritten, out-of-state, insurance, two-party, tax refunds, business, government and payroll. See the different types of checks that can be cashed using the Ingo Money App. 12 Best Check-Cashing Apps · 1. Brink's Money Prepaid · 2. Ingo Money App · 3. Netspend · 4. PayPal · 5. Western Union Netspend Prepaid · 6. Green Dot · 7. Venmo. Ingo Money is one of the most popular check cashing apps, known for its speed and reliability. It offers instant check cashing options, although. —The Check Cashing Store/Money Mart charges 10 PERCENT which is $ So, no. And their app is currently undergoing a huge upgrade so it will be. QuickCheck lets you monitor your check cashing activity right from our mobile app, plus our web-portal lets you easily approve/decline checks that need. 4. Brinks Money Prepaid Mobile App · Fast Approval: Checks can be cashed and deposited into your Brinks prepaid account almost instantly. · ATM. Lodefast check cashing app gives you the option of cashing your check with the use of your mobile phone. Also, you can send money to your bank account at any. Ingo Money is one of the most popular check cashing apps, known for its speed and reliability. It offers instant check cashing options, although. Deposit checks from almost anywhere with the Bank of America Mobile Banking app Footnote[1] on your smartphone or tablet. With the GO2bank TM app, you can safely and easily cash checks right from your phone and get your money when you need it. Easily add funds from a check to your spendwell account using Mobile Check Capture by Ingo® Money1 on the spendwell mobile app. good image of your check.

How Early Will I Pay Off My Mortgage

Overpaying your mortgage means you pay less interest in the future and pay off your mortgage sooner. This means you could save a lot of money. When you calculate how much interest you'll pay on this massive debt over the years, it makes sense to pay it off as soon as possible. However, after looking at. Pay off your mortgage early by adding extra to your monthly payments. NerdWallet's early mortgage payoff calculator figures out how much more to pay. If paying off your mortgage is within reach, you can pay it off early by making a lump-sum payment. If you still have five to 10 years of payments, paying a. Whether paying off the mortgage early is a good choice can depend on your financial situation, the loan's interest rate, and how close you are to retirement. Factors To Consider When Paying Off The Mortgage Early · Will you incur penalties for overpaying your mortgage?Some mortgage lenders have prepayment penalties or. There are three primary methods for making extra payments – pay extra each month, make a lump sum payment or switch to bi-weekly payments. Paying extra each. You will still be able to save on interest by tackling it this way and paying your loan off in less than 30 years. Is it worth it to pay off a mortgage early? A. By making consistent regular payments toward debt service you will eventually pay off your loan. Use this calculator to determine how much longer you will need. Overpaying your mortgage means you pay less interest in the future and pay off your mortgage sooner. This means you could save a lot of money. When you calculate how much interest you'll pay on this massive debt over the years, it makes sense to pay it off as soon as possible. However, after looking at. Pay off your mortgage early by adding extra to your monthly payments. NerdWallet's early mortgage payoff calculator figures out how much more to pay. If paying off your mortgage is within reach, you can pay it off early by making a lump-sum payment. If you still have five to 10 years of payments, paying a. Whether paying off the mortgage early is a good choice can depend on your financial situation, the loan's interest rate, and how close you are to retirement. Factors To Consider When Paying Off The Mortgage Early · Will you incur penalties for overpaying your mortgage?Some mortgage lenders have prepayment penalties or. There are three primary methods for making extra payments – pay extra each month, make a lump sum payment or switch to bi-weekly payments. Paying extra each. You will still be able to save on interest by tackling it this way and paying your loan off in less than 30 years. Is it worth it to pay off a mortgage early? A. By making consistent regular payments toward debt service you will eventually pay off your loan. Use this calculator to determine how much longer you will need.

You will still be able to save on interest by tackling it this way and paying your loan off in less than 30 years. Is it worth it to pay off a mortgage early? A. First: Is it smart to pay off your house early? To answer this, compare your mortgage interest rate versus other debt you may have. You can pay off your mortgage early, and in most cases, that's a smart decision. Here are strategies you can follow to pay off a mortgage faster and save. If you paid an extra $ per month, you'd save around $, over the full loan term and it would result in a full payoff after about 21 years and three. Tips to pay off mortgage early · 1. Refinance your mortgage · 2. Make extra mortgage payments · 3. Make one extra mortgage payment each year · 4. Round up your. If you decide that paying off your home loan early is right for you, what's next? Start by checking in with your mortgage servicing company. Did you know you. Paying off a Year Mortgage Early · Pay Extra Each Month. Take any leftover funds at the end of the month and make an additional principal payment. · Pay Bi-. When you pay off your mortgage early, the money is trapped in your home. If you get into financial difficulty, you're either going to have to. Ryan Peters, Wealth Planner with US Bank Private Wealth Management, shares how to determine if it's right for you to pay off your mortgage or invest extra cash. Based on the example above, if you add $50 to your monthly payment, you can pay down your loan in years. This saves you a total of $14, in interest. Paying off your mortgage early frees up that future money for other uses. Your mortgage rate is higher than the rate of risk-free returns: Paying off a debt. Making an extra payment each month or putting some, or all, of a cash windfall, toward your loans, could help you shave a few months off your repayment period. Generally, mortgage lenders are prohibited from imposing prepayment penalties on most home loans under the Dodd-Frank Act. If your mortgage is the exception to. How Long Will It Take to Pay Off My Loan? Calculator. No one enjoys being in debt, but it is a place we all seem to find ourselves at certain points in our. Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are required. How Long Will It Take to Pay Off My Loan? Calculator. No one enjoys being in debt, but it is a place we all seem to find ourselves at certain points in our. Paying off your mortgage early is especially effective if your mortgage is expected to have a high interest rate. This could be because you have a fixed-rate. The maximum allowable length for a mortgage is 25 years. However, you may have obtained a mortgage for 30, 35 or 40 years in the past. The National Association of Realtors estimates the average mortgage lasts 10 years. But that's largely because many people move or refinance. Do bi-weekly payments from Day One of the mortgage. This one simple choice can and does save you a ton of money down the road if you do nothing.